Overhead

The annual costs associated with maintaining a Delaware C-Corp:

- Franchise Tax: Delaware charges an annual franchise tax based on the corporation's authorized shares or the assumed par value capital method. The minimum tax is $175, but it can be higher depending on the corporation's share structure and amount of capital.

- Registered Agent Fee: Delaware requires all corporations to have a registered agent. The fee for this service can range from $50 to $300 per year, depending on the agent you choose.

- Annual Report Fee: Delaware corporations must file an annual report, which incurs a fee of $50.

- Federal and State Income Taxes: The corporation will need to file both federal and state income tax returns. While the cost of the taxes depends on the corporation's income, there may also be accounting and tax preparation fees, which can range from $500 to several thousand dollars annually.

- Legal and Compliance Fees: These can include costs for maintaining corporate records, meeting minutes, and ensuring compliance with state and federal regulations. These costs vary widely depending on the complexity of the corporation's structure and operations.

- Business Licenses and Permits: Depending on the nature of the business, additional licenses and permits may be required, each with its associated costs.

Here's a breakdown of estimated annual costs:

| Cost Type | Estimated Annual Cost |

|---|---|

| Franchise Tax | $175 - $200,000+ |

| Registered Agent Fee | $50 - $300 |

| Annual Report Fee | $50 |

| Federal and State Income Taxes | Varies |

| Accounting/Tax Preparation Fees | $500 - $5,000+ |

| Legal and Compliance Fees | Varies |

| Business Licenses/Permits | Varies |

Accounting Fees

The cost of accounting services for a Delaware C-Corp can vary widely based on the complexity of the corporation's financial activities, the volume of transactions, and the specific services required. Here are typical accounting-related costs:

- Bookkeeping:

- Cost: $200 - $500 per month for small to mid-sized corporations.

- Services: Monthly reconciliation of bank accounts, financial statement preparation, expense categorization, and maintenance of accounting records.

- Tax Preparation:

- Federal and State Tax Return: $750 - $3,000 annually for preparing and filing corporate income tax returns.

- Sales Tax Returns: Additional costs if the corporation is required to file state sales tax returns, typically $50 - $200 per filing.

- Payroll Services:

- Cost: $150 - $500 per month depending on the number of employees.

- Services: Payroll processing, tax withholdings, and filing of payroll tax returns.

- Audit and Assurance Services:

- Cost: $5,000 - $20,000 annually for small corporations; significantly higher for larger corporations.

- Services: Annual financial statement audits, internal control reviews, and compliance audits.

- Consulting and Advisory Services:

- Cost: Varies widely based on the scope and complexity of the engagement.

- Services: Strategic financial planning, mergers and acquisitions advisory, tax planning, and compliance consulting.

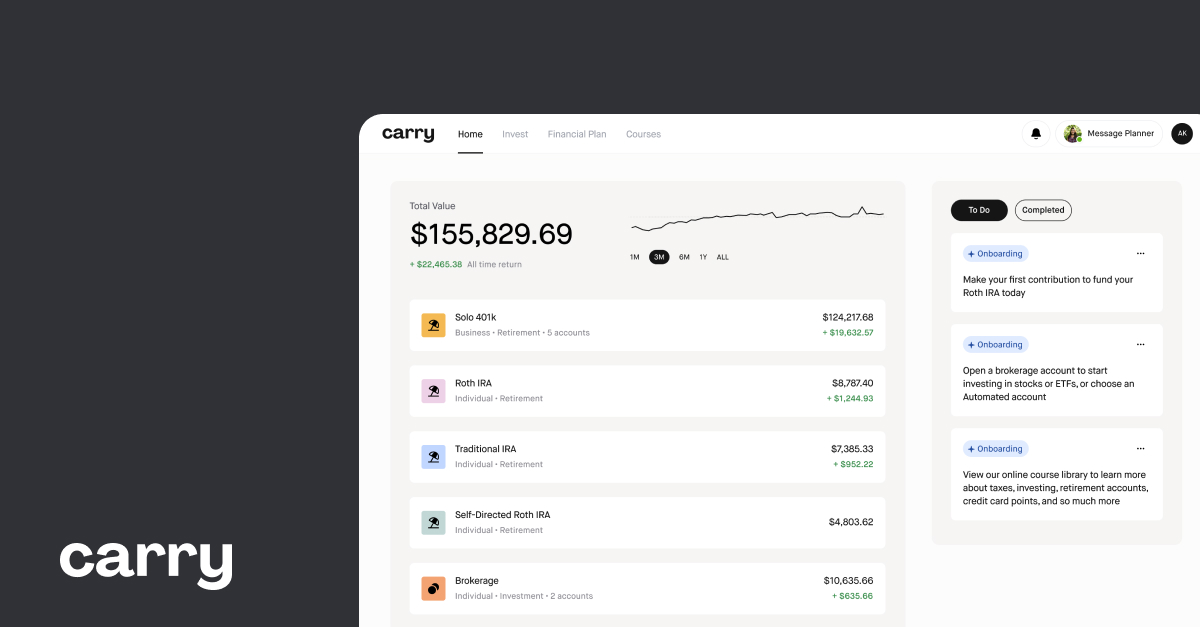

Carry - Grow your net worth with smart tax optimization

Carry is an all-in-one platform for tax-advantaged accounts, investments and strategy for business owners and high earning professionals.

For a Delaware C corporation, several forms are required to comply with both state and federal tax obligations. Here are the key forms you need:

Federal Forms

- Form 1120 - U.S. Corporation Income Tax Return: This is the primary federal tax form for C corporations. It reports the corporation's income, gains, losses, deductions, and credits.

- Form 941 - Employer's Quarterly Federal Tax Return: If your corporation has employees, you'll need to file this form quarterly to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks, and to pay the employer's portion of Social Security or Medicare tax.

- Form 940 - Employer's Annual Federal Unemployment (FUTA) Tax Return: This form is used to report and pay federal unemployment taxes.

- Form 1099-NEC or Form 1099-MISC: If you paid independent contractors $600 or more during the year, you need to report these payments.

- Form W-2 and W-3: These forms are required if you have employees. Form W-2 reports wages and taxes withheld, and Form W-3 is a summary of all W-2 forms issued.

State Forms (Delaware)

- Delaware Form 1100 - Corporate Income Tax Return: This form is used to report and pay the Delaware state corporate income tax.

- Delaware Annual Franchise Tax Report: All Delaware corporations are required to file this report and pay a franchise tax. The amount of the tax can vary based on the corporation's authorized shares or an alternate calculation based on the company's assets and issued shares.

- Delaware State Employment Tax Forms: If your corporation has employees in Delaware, you will need to file state employment tax returns, such as withholding tax forms and unemployment insurance forms.

Business taxes

Learn everything you need to know about business taxes.

C Corp Tax Returns Made Easy: Cleer Tax for Non-US Founders

Simplify C Corp tax return filing with Cleer Tax. Expertise tailored for non-US founders. Maximize savings, ensure compliance, and reduce admin time.